AUGUST BOOK OF THE MONTH

The New Conceptual Selling by Stephen E. Heiman, Diane Sanchez, and Tad Tuleja

Background: The New Conceptual Selling is part of Miller Heiman's strategic sales training platform developed in the late 1980s to enhance B2B sales performance through structured sales processes. Although Korn Ferry International acquired Miller Heiman in 2019, it still offers sales training worldwide under the original M-H brand.

Powerful Combination: Conceptual Selling (CS) was launched by Miller Heiman in 1987, shortly after the release of their blockbuster Strategic Selling (SS) program in 1985, which quickly became the Gold Standard of B2B sales platforms. Conceptual Selling (CS) was groundbreaking because it provided a structured approach to facilitating team selling and was ideally suited for selling complex, big-ticket, high-tech B2B deals. Conceptual Selling focused on preparing for the next goal-oriented, face-to-face sales meeting to create an “Advance” (not necessarily a “Close”) through a Conceptual Selling “Green Sheet,” which was designed to feed into and ultimately populate the strategic account plan, or what Miller Heiman called the Strategic Selling “Blue Sheet.” Corporate America loved the SS/CS combination and rapidly adopted it.

New Approach: Conceptual Selling (CS) provided big-game hunters with a structured approach to prepare for sales meetings across all departments involved – Engineering, Operations, Finance, Product Management, etc. This advancement ushered in a whole new era of coordinated "team selling." At the time, this new approach was groundbreaking even though, today, most successful sales training platforms have adopted elements of the Miller Heiman SS/CS approach in one way or another.

Product Selling vs Conceptual “Solution” Selling: Conceptual Selling (CS) introduced a contemporary selling framework because traditional approaches at the time focused on selling the product’s features and benefits, which were becoming ineffective in a rapidly evolving, informed, value-driven market. The authors argued sellers must stop selling product features and benefits and instead focus on better understanding a customer’s needs and building long-term consultative relationships. The "Conceptual Selling® Process" guides sales through stages using four principles: grasp the customer's buying process, align sales with it, create persuasive messages resonating with needs, and deliver value-driven solutions. Noteworthy concepts include Single Sales Objective, Valid Business Reason, Joint Venture Selling, Action Commitment, and Anti-Sponsor.

Customer-Centric Emphasis: Numerous industry success stories demonstrate the practical application of the Conceptual Selling® Process, leading to improved customer relationships, increased sales, and better outcomes. The book underscores the importance of cross-departmental collaboration for effective sales, aligning marketing, customer service, and product development. This approach enhances customer experience and contributes to better outcomes, higher close rates, reduced sales cycles, and improved retention.

Holistic Approach: Unlike traditional sales training programs focusing on closing deals, Conceptual Selling recognizes the extended customer journey. By prioritizing lasting relationships, the authors align with the customer experience's growing importance. Effective communication, active listening, and insightful questioning help salespeople provide genuine value. Tailor-made solutions are then crafted by addressing unique customer needs discovered through thoughtful dialogue.

Critique: While The New Conceptual Selling offers valuable insights, some industries may find the approach challenging to implement, particularly in high-volume, short-cycle, transactional sales.

Strategic Sales Platform: Miller Heiman’s Strategic Sales Platform was later expanded beyond SS and CS to include additional programs aimed at Channel Sales and selling into Large Accounts and Global Accounts:

Strategic Selling (SS)

Conceptual Selling (CS)

Successful Large Account Management Program (LAMP)

Successful Global Account Management (SGAM)

Channel Partner Management (CPM)

The Miller Heiman strategic sales training platform was primarily developed to help mid-to-large B2B companies sell to larger, more complex multinational enterprises. CS was billed as The Most Effective and Proven Method for Face-to-Face Sales Planning, which few could argue. Bang for the buck, the SS/CS combination was hard to beat.

Favorite Part: Chapter 14, “Beyond The Chumming Exercise,” features insights from an old friend of mine from Miller Heiman. I once worked alongside Mike Joyce, who was one of the most successful Miller Heiman advisors in North America. He was sharp as a tack yet down to earth and ate what he cooked. In Chapter 14, the authors highlight one of Mike’s concepts called “Chumming” and the dangers it introduces to the sales process. As I re-read his brilliant perspective again after all these years, I recall, as usual, he’s still right!

Conclusion: Conceptual Selling provides a comprehensive approach to improving your complex B2B sales performance. It champions a customer-centric, dialogue-based approach that equips sales professionals to excel in competitive markets. While some aspects might pose challenges in certain contexts, their emphasis on adaptability and relationship-building remains valuable. Backed by research, real-world examples, and actionable insights, this book is recommended for sales professionals striving for sustained success in complex B2B selling environments.

For more information about my perspective on sales training, please refer to my Two-Part Series on Sales Training, “High-Performance Sales Teams Use 8 Types of Sales Training” and “Selecting the Right Sales Training Platform for Your Business”

JUNE BOOK OF THE MONTH

Selling to the C-Suite by Nicholas A.C. Read

Overview: Selling to the C-Suite is an essential resource for anyone looking to master the art of selling to top-level executives. Nicholas A.C. Read, a renowned expert in the field of executive selling, presents a wealth of knowledge distilled from his extensive experience and research. The book provides sales professionals with a practical step-by-step guide into the art of selling to top executives in the business world. He combines real-world examples and case studies to illustrate his points effectively. These examples inspire and demonstrate the applicability of the concepts in various business scenarios.

Review: The First Edition of Selling to the C-Suite came out in 2009 and was groundbreaking because it focused more on what the executive was buying than how or what the salesperson was selling. The empirical research was gathered by surveying and interviewing over 500 senior executives and decision-makers about what they look for when salespeople call.

The Second Edition came out in 2018 to address three significant developments in selling and buying practices since the book's first edition. Read describes the three changes this way:

Social Media. The advent of Social Media provides today's salespeople with new ways to identify and engage executives who can help improve their position and access to the ultimate decision-maker.

Digital Natives. Executives are now "Digital Natives," consuming massive amounts of data instantly available through the internet, websites, online search engines, and mobile searches (and, more recently, AI). In an era of information overload, how do you differentiate? How do you connect, stay connected, and remain relevant?

"Millenipreneurs." The rise in new ventures led by Generation Y "Millenipreneurs" who are starting companies faster, failing faster, selling quicker, and targeting faster growth than previous generations. With access to rapid funding from VC firms, Angel Investors, crowdfunding, and peer-to-peer lending platforms that require less rigor than traditional funding sources, there are significantly more younger executive decision-makers than ever before, and their buying patterns, decision criteria, and expectations have changed buying behavior dramatically.

One of the book's key strengths is its emphasis on understanding the mindset of C-level executives. Read takes you through the decision-making processes of these high-level decision-makers, shedding light on their concerns, priorities, and motivations. By gaining a deeper understanding of what drives executives, sales professionals can tailor their approach to resonate with their needs and challenges.

In addition to providing practical strategies, the book also addresses common challenges and pitfalls encountered in executive selling. Read acknowledges the complex dynamics of selling to top executives, including the resistance to change and the skepticism towards salespeople. He offers insightful advice on overcoming these challenges, emphasizing the importance of building trust and credibility.

The book provides practical strategies and techniques to understand the mindset of C-level executives, build meaningful relationships with them, and ultimately close high-stakes deals. The heart of the book resides in Chapters 5-8, where Read explains how to engage and work with C-Suite executives:

How to Gain Access to the C-Suite

How to Establish Credibility

How to Create Value

How to Cultivate Loyalty

I've coached sales teams for years on how to become the executive's "Trusted Advisor." These four chapters provide an excellent overview to help you position yourself as their Trusted Advisor. The executive is looking for the salesperson to provide insight into things his staff can't. Tell me something I don't already know. What is the competition doing? How do we compare? What new technology or solution is about to hit the market? How can you solve my problems? To differentiate, you need to provide value, not just another pitch.

Beyond building relationships with executives, Selling to the C-Suite covers a wide range of topics, including understanding their language and mindset, creating value propositions, and delivering impactful presentations. One of the book's highlights is the chapter on crafting compelling value propositions. Read introduces a framework that enables sales professionals to align their offerings with the strategic priorities of C-level executives. This approach ensures that the sales pitch resonates with the needs of the top decision-makers, increasing the chances of success.

Endorsements: Besides obtaining a ringing endorsement and the Foreward from the legendary Neil Rackham, author of SPIN Selling, the book was endorsed by Dr. Dan C. Weilbaker, Ph.D., Professor Emeritus of Sales, Northern Illinois University. I had the distinct pleasure of working with Dr. Weilbaker and his talented staff while serving on the Board of Advisors for the highly-rated NIU Sales program.

"As an educator on the college level teaching professional selling, I found this book to be invaluable if you are interested in learning how to sell to top executives. Not only does it help you understand when to engage the executive, it also tells you how to get access. If that was not enough, the book also focuses on how to create value and build credibility with the executives. It's a must-read for anyone who interacts with top executives."

- Dan C. Weilbaker, Ph.D., Professor Emeritus of Sales, Northern Illinois University.

Conclusion: Selling to the C-Suite is a comprehensive and practical resource that equips sales professionals with the tools and knowledge needed to succeed in executive selling. The book's emphasis on understanding the mindset of top-level decision-makers, along with its actionable strategies and real-world examples, make it an indispensable guide for anyone seeking to build meaningful relationships with C-level executives and close high-stakes deals. Whether you are a seasoned sales professional or a relative newcomer, this book will undoubtedly enhance your ability to navigate the complex world of executive selling.

March BOOK OF THE MONTH

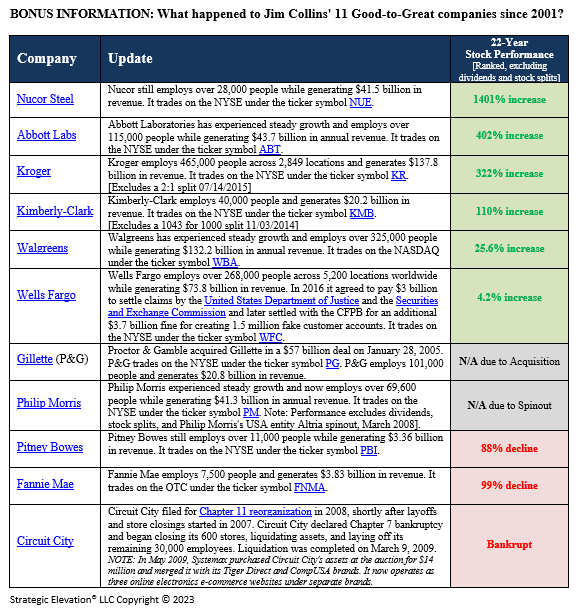

Good To Great – Why Some Companies Make the Leap…and Others Don't by Jim Collins

About the Author – Jim Collins is an American researcher, author, speaker, teacher, and consultant who has written extensively on the topics of business management, organizational performance, and sustainable growth. In addition to writing Good to Great, he wrote Built to Last and How the Mighty Fall.

Overview. Good to Great was a game-changer when it came out in 2001. Years earlier, Collins had dinner with Bill Meehan, the Managing Director of McKinsey's San Francisco office. Meehan challenged Collins' conventional thinking by opining that most great companies were already great and came from solid lineages like David Packard and George Merck. Meehan suggested that the next tier of so-called good companies might never achieve greatness because it's much easier to settle for just being good. Being great is hard. The vast majority of companies were good companies and may never experience greatness. Collins set out on a journey to find the answer to the question, "Can a good company become a great company, and if so, how?"

Scope. Collins launched a five-year research project involving 20 MBA students at Stanford University to analyze and compare a group of 28 companies' performance over time. Their analysis identified 11 companies that had gone from good to great. This group had beaten the general stock market by an average of 7x in 15 years, which more than doubled the results delivered by a composite index of what was considered the gold standard of businesses at the time of Intel, GE, Merck, and Coca-Cola.

Structure. The book is organized into nine chapters and an Epilogue full of FAQs. Each chapter features a carefully crafted summary at the end that highlights the key points and takeaways encountered during that section. Collins organizes his research into the following concepts: (1) Good is the Enemy of Great, (2) Level 5 Leadership, (3) First Who, Then What, (4) Confront the Brutal Facts, (5) The Hedgehog Concept, (6) The Culture of Discipline, (7) Technology Accelerators, (8) The Flywheel and the Doom Loop, and (9) From Good to Great to Built to Last.

Research Methodology.

11 Featured Companies. Collins' team established technical search criteria to identify a group of companies from the Fortune 500 from 1965-1995 that consistently outperformed their peers and the overall market over a sustained (15-year) period. This group of featured companies included: Abbott Labs, Circuit City, Fannie Mae, Gillette, Kimberly-Clark, Kroger, Nucor Steel, Philip Morris, Pitney Bowes, Walgreens, and Wells Fargo.

17 Direct Comparison Companies. His team then established search criteria to identify a group of Direct Comparison companies (same industries) that occasionally outperformed their peers and the overall market. The group that made this list included: Upjohn, Silo, Great Western, Warner-Lambert, Scotts Paper, A&P, Bethlehem Steel, RJ Renolds, Addressograph, Eckerd, and Bank of America. They also included six Unsustained Comparison (short-term) companies, including Burroughs, Chrysler, Harris, Hasbro, Rubbermaid, and Teledyne, resulting in a combined list of 17 direct competitors.

Systematic Qualitative and Quantitative analyses. After thousands of articles, interviews, transcripts, financial reviews, and research on these 28 companies, the team was able to compare the good against the great to identify critical patterns and behaviors that the great companies did (or didn't do) versus the good companies to position themselves for sustained excellent performance.

Key Findings. The research team discovered many lessons along the way, but one "giant conclusion" stood above the others. Their research confirmed that "almost any organization can substantially improve its stature and performance, perhaps even become great, if it conscientiously applies the framework of ideas they [the Collins team] uncovered." Additional lessons learned from the companies that went from good to great:

Celebrity Leaders. Famous leaders with larger-than-life personalities who ride in from the outside were negatively correlated with taking a company from good to great.

Executive Compensation. There is no systematic pattern linking specific forms of executive compensation to the process of going from good to great.

Strategy. The strategic planning process did not separate the good-to-great companies from the comparison companies. Both sets of companies had well-defined strategic plans, used similar planning processes, and spent comparable amounts of time on long-range strategic planning.

What Not To Do. Good-to-great companies focused less on what to do, than on what not to do, and what to stop doing.

Technology. Technology-driven change has virtually nothing to do with igniting a transition from good to great. Technology can only accelerate a transformation but cannot cause a transformation.

M&A. M&A plays virtually no role in igniting a transition from good to great. Merging two mediocre companies never make one great company.

Focus on the business. Good-to-great companies create alignment and motivation by focusing on running their business rather than getting distracted by large-scale change management initiatives.

No Launch Event or Revolutionary Process. Good-to-great companies had no name, tagline, or launch event to signify the start of their transformation. Most were evolutionary, not revolutionary.

Greatness is primarily a matter of conscious choice. Good-to-great companies were not, by and large, in great industries; some were in terrible industries. Greatness is not a function of circumstance (i.e., sitting on the nose cone of a rocketship).

What I Found Interesting. Few people realize that as unfortunate as Collin’s only high-profile bankruptcy was of his original 11 Good To Great companies, a rise-from-the-ashes story emerged shortly before the Circuit City bankruptcy happened. The Circuit City management team accelerated the spinoff of another one of their start-ups, called CarMax (NYSE: KMX), which has since grown into a juggernaut that today employs 32,647 people and generates $31.9 billion in annual revenue.

It’s interesting to note that even when the original Circuit City business model was failing to keep pace with their larger rival, BestBuy, their leadership team had the foresight and was able to fund and launch the next great idea – while continuing to build both businesses for a few years until they were able to safely step off the sinking Circuit City ship and onto the CarMax lifeboat they had launched.

Summary – Good To Great organizes a highly complex, multi-year research project into groups of insightful examples using a framework that supports and explains their findings. The case studies were well-researched and easy to follow, and I appreciated the handy summaries at the end of every chapter. I was impressed with the breadth and depth of the research put forth to write the book. Based on years of empirical research, data gathering, interviews, and real-world examples, it provides an understandable path for helping companies move from good to great.

JANUARY BOOK OF THE MONTH

Well Made in America: Lessons From Harley-Davidson on Being the Best by Peter C. Reid

After taking a trip to Milwaukee this past weekend to tour the Harley-Davidson museum, I simply couldn’t resist writing about this amazing American business turnaround story!

Interestingly, I was introduced to Well Made In America in 2002 by a close personal friend who’s related to the central character, Vaughn Beals.

In 1981, Vaughn Beals was the CEO of the Motorcycle Division of AMF and lead a team of 12 Harley-Davidson executives through a leveraged buyout (LBO) from American Machines & Foundry, Inc. (AMF).

AMF, the gigantic conglomerate that owned Harley-Davidson for the previous 11 years, ran the company into near extinction by cutting corners and taking so much cost out of the Harley-Davidson motorcycles that they were unbearably unreliable and hard to sell, even by their own loyal network of Harley dealers. Market share had dropped from 77.5% in 1973 to just 30.8% in 1980.

The $81.5 million LBO had to be pulled off just as sky-high interest rates were tanking the US economy and Japanese manufacturers flooded the market with higher-quality, low-cost motorcycles. The risks couldn’t be higher.

Well Made In America leads you through its tumultuous ride while providing valuable lessons today’s business leaders can use.

Adapting to a Customer-Driven Era

Six Strategies Harley-Davidson Used to Beat Its Competition

How Harley-Davidson Avoided Bankruptcy

Going Private: Living with an LBO

Four Basic “World-Class” Manufacturing Strategies

The Productivity Triad – JIT, EI, & SOC

Tactics for Getting Suppliers Into the Act

Turnaround: From Survive to Thrive

Going Public: How Harley Ran for Daylight

Three Key Strategies You Can Use

The legend of Vaugh Beals and the Harley-Davidson turnaround has been a topic used in MBA case studies for decades.

The magical turnaround story has been featured in some of the best business books written over the last few decades, such as John C. Maxwell’s, “The 17 Essential Qualities of a Team Player”, and “From Good To Great,” by Jim Collins.

I recommend picking up a copy of this fantastic American business turnaround story and, if you get a chance, tour the Harley-Davidson Museum too! If you’re a motorcycle enthusiast like me, you’ll walk away with a new appreciation for the history of the “Hog”!

December Book of the Month

Rocket Fuel by Gino Wickman and Mark C. Winters

Rocket Fuel is Gino Wickman’s 2015 follow-up book to his best-selling powerhouse book called Traction, first published in 2011.

Wickman’s first book, Traction, introduced us to the 6-Key Components of the EOS Entrepreneurial Operating System:

VISION – Clarify, document, and communicate the new Vision, embraced by management and shared by all.

PEOPLE - Right People in the Right Seats

PROCESS – All processes are documented & followed

ISSUES - Issues List / Identity, Discuss, Solve (IDS)

DATA - Scorecard / Measurables / Rolling 13-Week View

TRACTION – Quarterly Rocks / Meeting Pulse / Agenda / Accountability

Rocket Fuel complements Traction by clarifying the two most important roles in an entrepreneurial business – the Visionary and the Integrator – while examining the complex relationship between the two.

Key Takeaways:

Rocket Fuel dives deeply into the roles and the relationship between the Visionary and Integrator (V/I). It provides a roadmap for clarifying V/I roles and responsibilities. Perhaps more importantly, it gives us “Rules and Tools” to help manage the complex relationship between the Visionary and the Integrator as they learn their new roles and how to work together.

The 5 Rules used in a successful Visionary/Integrator relationship:

Stay on the same page

No end runs

The Integrator is the tiebreaker

You are an employee when working “in” the business

Maintain mutual respect

Top 5 Tools used in a successful Visionary/Integrator relationship:

The Accountability Chart

Core Questions – Core Values & Focus, 1/3/10-year Plan, Ideal Customer, etc.

The 90-Day World

Weekly Level 10 Meetings

The Scorecard

Summary:

Rocket Fuel is written for the Entrepreneurial Business Owner and their second-in-command (#2 executive, and to a lesser extent, their executive team) as they learn the new process and how to work together to implement the EOS system.

The authors focus on the roles that each of the company’s two top executives need to embrace as they begin implementing the EOS model. Rocket Fuel is loaded with great examples and templates to help the owners/leaders get started on their EOS journey. Adopting these rules, tools, and templates is necessary for the company to transition from an entrepreneurially-run to a professionally-run company. By doing so, the company will build the operating structure necessary to achieve its goals and reach its full potential.

Business Owners:

If you’re looking for a proven methodology to help take your small-to-mid-market business to the next level, read Rocket Fuel (along with Traction, if you haven’t done so already). I would also highly recommend engaging an experienced EOS Implementer to help you set up the infrastructure, reporting, and cadence to keep you and your executive team on track. If you’re uncertain where to begin, drop me an email, and I’ll be glad to introduce you to my network of highly recommended EOS Implementers.

OCTOber Book of the Month

“The New Strategic Selling” by Robert Miller Stephen Heiman

"Strategic Selling" was first published in 1985, the same year I moved to Chicago to launch my career in Sales. My first sales job was selling long-distance services to businesses on the streets of Chicago. I soon discovered I had a knack for selling and persuading people to buy my products and services, but I wanted to sell big-ticket solutions and lacked formal training in selling large, complex deals.

Over the next few years, I progressed from selling long-distance services to selling cellular phones, PBX/PABX equipment, uninterruptible power supplies, engineering services, cellular network infrastructure systems, and eventually long-term (e.g., 5-10 year) energy outsourcing agreements to some of the largest companies in the country.

At the time, most of the sales training I received was done in-house, with proprietary sales training programs developed specifically for their own sales teams as their captive audience. Most of my early sales training focused on the one-on-one sales event, which some call "belly-to-belly" selling. Sales training was rudimentary and typically emphasized questioning techniques, identifying pain points, handling objections, trial closes, etc.

I was first introduced to the Miller Heiman Strategic Selling platform in 1998 while selling big-ticket energy outsourcing agreements. Contract values were typically in the $10s of millions to $100s of millions of dollars. It was big game hunting, and I loved it, but it was a new world. Since I had no previous formal sales training to guide me through the complex sales process, I knew I needed to adapt to sell large, complex deals successfully. I knew I needed a better way to manage opportunities through the process so I could scale up and close more deals.

The company I joined had spent the prior year researching all available sales processes and sales training platforms and determined that Miller Heiman's suite of programs was "Best in Class" for big-ticket, complex, team-selling pursuits. They were in the early stages of implementing the Miller Heiman platform across their entire sales organization and decided to launch with Miller Heiman's core components of:

Strategic Selling (Blue Sheet)

Conceptual Selling (Green Sheet), and

Large Account Management Process (Gold Sheet)

Strategic Selling was a "game changer." It focused on managing the entire account, preparing, planning, inventorying, assessing, and positioning each customer account and interaction in a systematic, logical progression. It provided a simple way to organize and advance my deals in a way that I had already learned to do on my own in a very rudimentary, haphazard way. The Strategic Selling "Blue Sheet" brought it all together and gave me a tool to help me advance my deals in a formalized, structured way. The Strategic Selling Blue Sheet gave me my first "Ah-ha!" sales growth moment, and once I understood how an effective sales process would allow me to organize and communicate deals in my sales funnel, I was off to the races.

Strategic Selling reinforced that I was on the right track and gave me a secret weapon to become more effective and efficient in communicating my deals across the sales team and the broader organization. I liked Strategic Selling so much that I decided to represent Miller Heiman's strategic sales training services as an independent, authorized advisor for three years (2002-05).

Strategic Selling has been updated four times since 1985, sold millions of copies, and changed how B2B companies sell their products & services. Strategic Selling's game-changing principles and methodologies have been copied, mirrored, or adopted by many other sales training platforms on the market today. Here are a few of my favorite concepts within Strategic Selling:

Four Buying Influences (Economic Buyer, User Buyer, Technical Buyer, Coach)

Ideal Customer Profile (ICP) Demographics, Psychographics, and ICP Scoring

Leveraging Strengths

Win-Win

Red Flags

Sales Funnel & Action Plans

Although Strategic Selling is undeniably the "Granddaddy of them all for B2B selling," it's not a silver bullet, nor should it be used in every business. Strategic Selling provides a proven, robust B2B sales platform and is ideal for certain companies but may be time-consuming and cumbersome for others. Here are a few key attributes you should consider when determining which sales process/platform to adopt within your company.

Best fit characteristics for Strategic Selling:

Business Types:

Business-to-Business (B2B)

Enterprise-to-Enterprise (E2E)

Selling Environment:

Complex, Solution Selling

Collaborative, Team Selling

Remote Selling

Deal Types:

Highly Customized, or Engineered Solutions

Larger Complex deals

Longer Sales Cycles (6-12 months)

Multiple Decision Makers & Influencers

Non-Standard Contracts

Summary:

Out of necessity, and after years of trial and error, I learned many of the concepts inherent in Strategic Selling on my own. It was a painful and expensive process, and I lost far too many deals along the way. A much faster, less costly path to success would have been to embrace the Strategic Selling approach much sooner. If only I had known about Strategic Selling sooner!

Sales Leaders: If you believe Strategic Selling aligns with your business, don't delay. Implement asap, and don't look back. Give your sales team the tools they need to succeed as soon as possible. Good selling!

What did you think? If you’ve read it before, send me an email with your take on the book, and let me know your favorite concepts, quotes, passages, and lessons.

July BOOK OF THE MONTH

The Qualified Sales Leader by John McMahon

Summary: The Qualified Sales Leader, Proven Lessons From a Five-Time CRO by John McMahon is an indispensable guide for sales leaders looking to transform their teams and achieve sustainable success in today's competitive business landscape.

Drawing on his extensive experience as a sales leader and consultant in the Enterprise Technology, Enterprise Software Sales, and Software-as-a-Service (SaaS) space, McMahon provides a comprehensive framework that equips readers with the necessary skills, strategies, and mindset to thrive in a big-ticket B2B Enterprise Sales Leadership role.

From recruiting and hiring top talent to developing high-performing teams, running effective Quarterly Business Review (QBR) meetings, and driving revenue growth, this book is an easy-to-read roadmap for sales leaders seeking to maximize their potential and make a lasting impact.

Review: The Qualified Sales Leader was first published in 2021. In it, John McMahon tackles the complex and multifaceted role of sales leadership. The author's knowledge and experience shine as he guides readers through some of the most important aspects of sales leadership while providing valuable advice and actionable strategies along the way. The book was impactful because it focused on developing practical lessons for the less experienced Sales Manager while effectively using storytelling to get his point across rather than creating esoteric models, concepts, or gimmicks.

Hiring the Right People. One of the book's key strengths is its focus on the importance of building a strong foundation by hiring the right people. McMahon emphasizes that the success of a sales team starts with recruiting and selecting individuals who possess the right skills, attitude, and cultural fit. He delves into the nuances of effective interviewing techniques and highlights the significance of ongoing training and development to ensure long-term success. In Chapter 27, Q & A with the Managers, he describes Character as the key difference maker and identifies his Top Five Character Traits of an A-Player Salesperson – (1) Intelligence, (2) Persistence, Heart, & Desire (PHD), (3) Coachability and Adaptability, (4) Integrity, and (5) Curiosity. While I endorse McMahon’s view on hiring the best, I also recognize it’s easier said than done in certain industries; I provide a dose of reality to SMB Sales Managers in the Context section below.

Motivating Sales Teams. McMahon recognizes leadership's critical role in inspiring and motivating sales teams. He emphasizes the need for sales leaders to cultivate a positive and collaborative work environment where team members feel supported and empowered. Through engaging anecdotes and practical examples, he illustrates how effective communication, coaching, and performance management can create a culture of excellence while driving exceptional results.

Common Theme. One noteworthy point is that McMahon uses common sales terminology throughout the book – many of which are directly from the Miller-Heiman Strategic Selling platform introduced in 1985, over 35 years earlier. Examples include Economic Buyer, Champion, Coach, Ideal Customer Profile (ICP), Propensity to Buy, Sales Complexity, etc. For me, it just reinforces how powerful and effective the Miller-Heiman platform is, having stood the test of time while still cranking out high-performance sales teams decades later. And although I appreciated all the concepts McMahan deployed in the book using Miller-Heiman terminology to illustrate a point, I found very few sales concepts in this book are uniquely his own – with two exceptions – his take on recruiting A-Players and his concept of MEDDPICC, an acronym he created that mostly aligns with, and parallels, the Miller-Heiman sales process. MEDDPICC stands for Metrics, Economic Buyer, Decision Criteria, Decision Process, Identify the Pain or Initiative, Paper Process, Champion, and Competition.

Context. McMahon stakes his reputation on believing that sales managers must hire the best sales reps possible (A-Players) and incorporate “character” as a key recruiting criterion. Although I fully support this approach and its conclusion, it is not new. In fact, recruiting A-caliber salespeople is an age-old problem that highlights one of the largest needs in corporate America today. Considering the fact that there are only so many A-caliber salespeople to go around, this shortage won’t be solved anytime soon.

Considering most of Mr. McMahon’s experience hiring A-Players occurred while he ran Sales or advised “Unicorn” startups like Qualtrics, Datadog, MongoDB, Okta, AppDynamics, etc., in Silicon Valley, during their heyday, I suspect luring A-caliber players using valuable stock options and highly-leveraged compensation plans made attracting and retaining A-caliber players much easier than what a typical middle-market SMB manufacturer would be able to offer.

Many small to middle-market businesses don’t have large budgets to pay recruiters and often struggle to locate and attract A-Players. If they are fortunate enough to land an A-Player, many SMBs will struggle to pay them enough to retain them, and they’ll eventually be hired away by larger competitors with deeper pockets. What would be most helpful for SMB Sales Leaders is to provide tips on how to locate and hire B+ Players (B-Players with lower compensation expectations and a ton of upside potential) while building a structure for turning them into A-Players through training, coaching, and other developmental programs. For my perspective, please refer to my article, "The 8 Types of Sales Training High-Performance Sales Teams Use."

Conclusion: The Qualified Sales Leader by John McMahon is a must-read for sales leaders at all levels of experience, but especially newly promoted Sales Managers. With its comprehensive approach, practical advice, and insightful strategies, this book offers an invaluable resource for sales leaders looking to elevate their teams and achieve sustainable success. Whether you are a seasoned sales leader or an aspiring one, McMahon's expertise and guidance will help you become a more qualified and effective sales leader in today's dynamic business environment.

APRIL BOOK OF THE MONTH

Take Care of Your People – The Enlightened CEO’s Guide to Business Success by Paul Sarvadi

About the Author – In 1986, Paul Sarvadi co-founded the company known today as Insperity. He took the company public through an IPO in 1997. To this day, Paul Sarvadi remains their Co-Founder, Chairman & CEO. He has built this amazing American rags-to-riches story into an industry leader with over 3,500 corporate employees, serving over 100,000 clients and generating over $5.0 billion in revenue. Insperity trades on the NYSE under the ticker NSP.

Overview. I was recently given a copy of Take Care of Your People by Joe Gurreri, an Insperity Certified Business Performance Advisor in greater Chicago. Initially, I was skeptical. My experience with many CEO-written books is that they’re mainly for marketing purposes rather than providing readers with useful, actionable insight, expert advice, and noteworthy examples. I was curious if this book was any different, and I am glad I kept an open mind.

Approach. I found Sarvadi’s approach genuine, believable, and knowledgeable. He shared personal stories told from the perspective of an HR leader who found a way to break molds and build a business in an industry that didn’t even exist. Back in 1986, Professional Employee Organizations (PEOs) and the concept of outsourcing the HR function were new. As an industry trailblazer, he describes some of the challenges he faced in his early years. Some made him question his own vision and limitations.

Structure. The book is organized into twelve chapters. Sarvadi develops his ten strategies based on decades of lessons learned, and wisdom gained. Chapters 3-11 include a section at the end called “Thinking Strategically” and “Thinking Systematically,” which provide actionable insights to help you implement the chapter’s concepts. The last chapter (technically the thirteenth) is titled “Should We Continue the Conversation?” and is more of an infomercial about Insperity and what they do. So if you’re unfamiliar with PEOs and want to learn more about HR Technology and outsourcing HR, start here.

Chapters are logically laid out to explain Sarvadi’s 10 Strategies:

Strategy #1 - Getting Your Culture Right. It is the foundation of everything else. Culture is the unique personality of a business that influences behaviors, attitudes, business decisions, and, ultimately, business performance.

Strategy #2 - Finding, Hiring, and Keeping the Best. Techniques for Recruiting, Selection, and Retention that turn your workforce into a team of all-stars who gel with one another and support the organization’s culture.

Strategy #3 - Compensation, Recognition, and Rewards. For top performers, it’s more than a paycheck. He recommends, and I fully agree, that top companies supplement their competitive compensation plan with a robust rewards and recognition program.

Strategy #4 – Compliance & Liability Management. The critical nature of compliance in today’s ever-changing landscape of HR regulations and how to protect the company from damaging lawsuits and legal claims.

Strategy #5 – Employee Performance Improvement. How to get the most out of your workforce by optimizing performance reviews, training, and professional development.

Strategy #6 – Employee Administration & HR Technology. Harnessing HR technology to convert bureaucracy into a high-performance operation.

Strategy #7 – Human Capital and M&A. What’s important to know about Human Capital management before buying or selling a company.

Strategy #8 - Organization & Leadership. Even the best employees need a leader who can communicate their vision and priorities while ensuring all departments are aligned and working towards common goals.

Strategy #9 - Employee Communications. Open-door policies help build trust and loyalty. Communication styles, the use of emotion, and message tailoring are all critical elements of an effective employee communication strategy.

Strategy #10 - Faith at Work. “Having “entrepreneurial conviction” - the value of having faith in yourself and what you’re doing as you work to build something great.”

Personal Observation. Some of Sarvadi’s HR concepts align brilliantly with elements of the Entrepreneurial Operating System (EOS) model. I see parallels that start with defining the Mission, Vision, and Values while using a strategic and thoughtful approach to communicating the new Vision across the organization. They both emphasize having the Right People in the Right Roles and ensuring Processes are documented and followed.

Although many building blocks are similar, the EOS model also provides the added benefit of an implementation structure and methodology that defines deliverables and puts them in motion. Whenever I see concepts that align with the EOS model, it reinforces the notion that these concepts are well-established and battle-tested.

Compelling Concepts. The book was stacked with a number of terrific concepts and principles that you can deploy immediately. I especially liked: The Three Levels of an Effective HR Strategy (Administration, Transaction-Driven; Process, Event-Driven; and Strategic, Outcome-Driven); Big-League Recruiting Strategies; The Case for Background Checks; How to Woo Candidates You Can’t Afford; The 4-C’s of Onboarding – Compliance, Clarification, Culture, and Connection; and many more, but my personal favorite was Sarvadi’s concept of The Human Capital Multiplier.

The Human Capital Multiplier. Sarvadi makes a strong case for elevating HR to a much more strategic level across the business. He observes that many of the thousands of SMB owners he’s worked with over the years focus on four of the five major strategic areas key to any organization’s success – Sales, Finance, Operations, and Technology. Unfortunately, SMBs often overlook Human Capital from a strategic point of view.

Sarvadi explains that although many business leaders think of HR as the “fifth wheel” or “red-headed stepchild” of the organization, they don’t do it as a conscious choice but rather a practical reality due to time constraints and misguided priorities. He rightly points out that these four other strategic areas need Human Capital to thrive. HR is the Human Capital Multiplier that makes other functions more efficient and effective. Successful companies rely on HR to ensure they have the right people in the right roles, doing the right things at the right time. His point is simple – to run a successful business in today’s complex business environment, HR needs a prominent seat at the table. I couldn’t agree more.

If you’d like to elevate your team’s Sales Performance, let’s schedule a confidential meeting today!

February BOOK OF THE MONTH

The Growth Gears: Using a Market-Based Framework to Drive Business Success by Art Saxby & Pete Hayes

Introduction – I was first introduced to Growth Gears in 2022 by a colleague who’d been a CMO for over 20 years. For the past five years, he’s been a Fractional CMO with Chief Outsiders and is widely considered an expert in Marketing Strategy.

About the Authors – Art Saxby & Pete Hayes are co-principals of Chief Outsiders, LLC, a management consulting practice serving thousands of businesses nationally by providing experienced marketing executives to small and midsized businesses on a fractional basis to accelerate growth. Pete and Art bring their decades of executive marketing experience to lead you from insight to strategy to execution. Chief Outsiders is a Strategic Partner of Sales Xceleration, the world’s largest Fractional Sales organization.

Validation. The authors earned instant credibility based on the book’s first endorsement, written by Sam Reese, CEO of Vistage. I’ve known Sam for many years and hold him in the highest regard, based on the years we worked together at Miller Heiman before his move to Vistage.

In Growth Gears, Art Saxby and Pete Hayes set out to “demonstrate that leaders of companies should approach marketing as a logical, linear set of steps or gears – the Growth Gears, if you will – that drive their business.” The authors explain that the three gears – similar to the gears of a bicycle – will allow a business owner to accelerate growth. The authors describe the three Growth Gears as:

1. Insight. Leverages insights about itself, the customer, and the competition to make better decisions.

2. Strategy. Companies can create and maintain an informed strategy around their market, offerings, and positioning using the knowledge gained in the first gear, Insights.

3. Execution. Once the right strategy is in place, the final gear is about efficiently executing the strategy using the right resources, tactics, and metrics.

They go on to explain the difference between an “operationally-focused” organization and a “market-focused” organization, the types of leaders that are best at running each, and their suggested approach to transforming from one to the other. They conclude that the best-run companies often have the hardest time growing because the skills it takes to run a company and the skills it takes to grow a company are two very different things.

Interesting Research-Based Study – What I found interesting is the research they did with the McCombs School of Business at The University of Texas at Austin in 2011. They surveyed 200 CEOs from 27 different industries. Their results were mostly predictable, with one important revelation. Their research confirmed that two groups of CEOs, which most marketers would normally associate with a particular type of company (Operationally-Focused vs. Market-Focused), were actually most aligned with the opposite group.

Here’s a summary of their findings:

They discovered that CEOs with Sales backgrounds were more aligned with Operationally-focused companies (internally oriented, processes, procedures, metrics, etc.) than Market-focused companies (externally-oriented, new technology, new products, etc.). In a parallel but opposite way, CEOs with IT backgrounds were typically more Market-focused than Operationally-focused.

I found this discovery fascinating but understandable after they explained their rationale. The authors explain their findings in the following way:

- Sales Leaders. Initially, the researchers thought Sales Leaders would be considered externally focused because they are customer-facing. The results confused the researchers. Don’t you want your salespeople focused outside the company’s four walls, talking to customers and selling? While that’s true, the job of the Sales Leader is to lead, not sell. He is responsible for building the sales infrastructure and sales processes that improve sales results. Sales Leaders are actually internally focused and accustomed to working within their four walls to remove obstacles to accelerate the sales process for their sales teams. Sales Leaders are very much different than salespeople in this regard.

- IT Leaders. Initially, the researchers thought IT Leaders would be considered internally focused because they are responsible for running the systems. But the research helped them realize IT Leaders spend their entire careers looking out the window, trying to determine what new technology is on the horizon, and spend years planning, preparing, and building the systems of tomorrow rather than focusing on the day-to-day aspects of running their existing networks, which are mostly handled by their management team. The CEO of an IT company probably spends more time looking outside the company than just about any other type of CEO.

They conclude that a CEO’s background has more to do with how the company is run than any other factor. They suggest that if you’re a CEO from an operationally-oriented background, you may not realize it, but you’ve likely staffed your executive team with other operationally-oriented backgrounds as well (Operations, Manufacturing, Engineering, Logistics, Finance, Sales). If that’s the case, is it a surprise that you’re all probably looking at the business from the same perspective?

Summary – Growth Gears is a fascinating read and highlights the tendencies of why CEOs run their companies the way they do. More importantly, it provides a path forward for helping companies transition from well-run operationally-focused to market-focused growth companies. The book is well organized, providing a simple framework, useful examples, case studies, and easy-to-follow steps for identifying and adding these “gears” to give your company a set of repeatable behaviors and processes to maximize your company’s full potential.

NOVEMBER BOOK OF THE MONTH

Becoming an Insightful Leader by David Spitulnik

I've known David Spitulnik for over thirty years. He is the Managing Partner of Spitulnik Advisors, LLC in Evanston, IL, a privately held consultancy that provides planning, coaching, and advisory services for small to middle-market companies.

We worked together at Motorola many years ago, and we recently had the opportunity to reunite after an extended absence, where I learned he had written a book he offered to share with me. I jumped at the chance to read his book!

The Three "I's" Pyramid of an Insightful Leader - Intelligence, Inclusion & Influence. Spitulnik credits Pearl Zhu, writer of the "Future of CIO" Blog, for identifying these three qualities that must be understood and practiced to become an Insightful Leader. He intentionally builds on the Three "I's" concept to help the reader understand what it takes to become an Insightful Leader. Along the way, he shares some of his personal stories and lessons that emphasize many essential concepts, including:

The Speed of Life

Personal Advisory Board

Leadership Decision Matrix

Adaptive Leadership

The Organizational Chart vs. The Reality Chart

Structure. Most chapters start with a short story written by owners of small-to-midsized businesses Spitulnik has coached along the way. The stories are real, told in the owner's own words, and designed to emphasize a time in their life when something impactful happened that changed their life or viewpoint. At the end of each chapter, Spitulnik provides a series of Takeaways, Exercises, and a set of Decision Matrix Questions.

Perspective. Being an impatient man, I've always appreciated life lessons from others who've already experienced success and are willing to share some of their most valuable lessons with you. Why not accelerate your personal development through the experiences of others? Each story can help you better understand a concept that can accelerate your journey. And best of all, you won't have to learn these lessons the hard way!

Summary. "Becoming an Insightful Leader" was a treat to read. It was a quick read packed with valuable tips and a reminder that leadership isn't a destination; it's a journey. I especially enjoyed the short stories and the structure of the book. If you're interested in personal development and becoming a better manager and leader, I'd recommend picking up a copy of Spitulnik's book, "Becoming an Insightful Leader."

SEPTEMBER’s book OF THE MONTH

I’ve known George Ludwig for nearly two decades now. We met shortly before his first book, “Wise Moves” was published in May 2003, and although it was a solid first effort, his next book, “Power Selling: Seven Strategies for Cracking the Sales Code,” was his magnum opus.

“Power Selling” was published in July 2004, coincident with a flurry of books that turned out to be some of the best B2B sales books to hit the market in recent memory. “Power Selling” has earned a seat at the table as one of the best sales books I’ve read in the past few decades. How can I say that? Simple. Not only are its underlying concepts field tested and proven, but it’s been roundly praised and endorsed by some of the most outstanding thought leaders and authors in Sales, Sales Training, and Sales Leadership in the last 30 years, including:

Brian Tracy, “Goals!”

Dave Stein, “How Winners Sell”

Todd Duncan, “High Trust Selling”

Danielle Kennedy, “7 Figure Selling”

Rick Page, “Hope Is Not a Strategy”

Anthony Parinello, “Selling to VITO”

Stephan Shiffman, “Getting to Closed”

Mike Bosworth, “Solution Selling,” and “Customer-Centric Selling”

Key Takeaways:

“Power Selling” is loaded with over 20 years of George’s life lessons and sales advice. His approach is bigger than just teaching a sales technique. Much bigger. He explains how his approach to reaching your full potential must include building a structural foundation necessary to develop winning habits that top sales professionals implement to foster a winning mindset and character. He explains the psychology of sales.

He boils it down to the seven powers you must master to become “Top Dog”: 1. Reputation 2. Real Passion 3. Research 4. Rapport 5. Resource Management 6. Resiliency and 7. Relationships.

“Power Selling” introduces you to ways to supercharge your psychology and physiology, how to become a trusted advisor, build client rapport, and the importance of continuing sales education & training. Each chapter includes a list of “Power Boosters,” a set of reminders that highlight recommended actions you should take to excel.

Summary:

“Power Selling” helps salespeople build credibility, confidence, competence, commitment, discipline, and character. “Power Selling” impacted me personally, and I recall wishing it had been available twenty years earlier - before I began my sales career. I quickly embraced its concepts and introduced it to many of my top-performing sales teams.

Sales Leaders: Read this book now (if you haven’t already) and make sure every one of your salespeople reads it too. It could have a profound impact not only on their sales results but their sales career as well. Good selling!

for business owners considering a fractional Sales solution:

“Hope Realized: Finding the Path to Sales Success”, by Mark Thacker, CEO of Sales Xceleration

My thoughts on the book:

This was a fun read, and I enjoyed it immensely. Mark Thacker has an easy-to-read writing style that inter-weaves life lessons with sales leadership lessons. Mark develops each character in a thoughtfully revealing way that makes you feel you’re getting to know them better with each subsequent meeting. He tells a story about how Steve, a CEO of a once-thriving tech company, now on the brink of failure, has a chance encounter with Vance, a wily and seasoned sales veteran at a 50’s-style diner called, The Fork. And as their relationship grows, so does Steve’s business. I enjoyed the way Vance coaches Steve through many of the same activities we use as fractional sales advisors. If you’re a business owner thinking about engaging a fractional sales leader, start here.

suggested reading:

The Prosperous Coach by Steve Chandler & Rick Livin

Dennis Clouse, a Sales Xceleration Advisor in Denver, CO, recommends:

The Prosperous Coach by Steve Chandler & Rich Litvin.

What did you think? If you’ve read it before, send me an email with your take on the book, and let me know your favorite concepts, quotes, passages, and lessons.